M&A Advisory Services

Providing Quality through Experience to Benefit Our Clients

Burke Financial Services (BFS) is a middle market full-service M&A advisory firm serving business owners and providing M&A Transactional Services to Private Equity Funds, Financial Sponsors, Other Accounting Firms, and Family Offices.

We provide a tailored approach with a focus on building value for our clients. For the last 20+ years, we have developed a broad base of industry and deal experience on both the buy-side and sell-side in every facet of the deal life cycle. Our unique blend of M&A Advisory and CFO experience sets us apart from our competitors. Not only have we closed hundreds of M&A deals, we have 23+ years of CFO experience managing, growing and developing companies from the inside. We share the same passion as ownership. This gives us the unique ability to assist you with building value and capitalize on it through a sale.

Our broad based experience is prevalent in the professional credentials we hold including:

Certified Public Accountants (CPA), Chartered Global Managerial Accountants (CGMA), Certified M&A Advisors (CM&AA), and MBA in Finance.

Contact us if you would like to learn more about each of these services.

“Download our white paper: How to Optimize Business Value”

Our Capabilities for Private Companies:

We offer a full spectrum of both Buy-Side and Sell-Side M&A Advisory Services. We tailor our approach to fit your timeline and budget. If you only need help is some areas (but not all) you can pick and choose our services services a la carte.

· FULL-SERVICE BUY-SIDE/SELL-SIDE DEAL MANAGEMENT

· EXIT PLANNING AND STRATEGY

· PRE-SALE READINESS

· VALUATION ANALYSIS

· QUALITY OF EARNING ANALYSIS

· OPPERATIONAL EFFECTIVENESS ANALYSIS

· GROWTH CAPITAL RAISE - RECAPITALIZATIONS

· CONFIDENTIAL OFFERING MEMORANDUM (CIM)

· PITCH BOOK

· MARKETING COMPANY FOR SALE

· COMPANY SEARCH PROJECTS

· DUE DILIGENCE MANAGEMENT

· DEAL STRUCTURING AND CLOSING

· DEAL TAX STRATEGIES AND ANALYSIS

· POST CLOSE INTEGRATION

Services for PROFESSIONAL firms:

We assist a number of Private Equity Firms, Financial Sponsors, Family Offices and Accounting Firms on an outsourced basis with their overflow of M&A work and with their non-core areas of expertise.

Need More Horsepower or to Accelerate your Deal Timeline?

BFS stands ready to assist you with any or all aspects of your M&A opportunity, accounting work and Outsourced CFO services. We have partnered with several firms. We can structure the engagement as a third party (we bill the client) or as a white label service (you bill client and we perform the work under your brand)

Every client engagement begins with an in-depth exploratory phase led by a partner level team member at BFS. We develop a foundational understanding of the proposed transaction, the investment thesis and tailor our service to meet your firm’s needs and strategic objectives.

Services for Professional Firms:

Quality of Earnings Analysis

Accounting Systems for M&A Platforms and Consolidated Financial Reporting

Turn-a-round Financial Management for Portfolio Companies

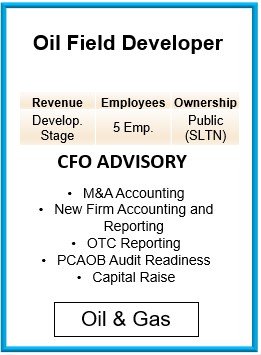

Outsourced CFO Services

Fairness Opinions

Manage Due Diligence Process

and Much More